OpenAI Pursues $750 Billion Valuation in Major Fundraising Round

OpenAI is in advanced discussions to raise new capital at a $750 billion valuation, marking a significant milestone for the AI leader and signaling continued investor confidence in generative AI's commercial potential.

OpenAI's Ambitious Valuation Target

OpenAI is reportedly in discussions to raise funds that would value the company at $750 billion, according to recent market reports. This valuation represents a substantial increase from the company's previous $500 billion valuation and underscores the accelerating investor appetite for artificial intelligence infrastructure and capabilities.

The fundraising round, if completed at the proposed valuation, would position OpenAI among the most valuable private companies globally. The move reflects the company's dominant market position in generative AI following the widespread adoption of ChatGPT and its enterprise offerings.

Market Context and Investor Appetite

The reported fundraising discussions occur amid a broader surge in AI investment and valuation expansion. OpenAI's trajectory from a $1 billion valuation in 2021 to a potential $750 billion valuation demonstrates the explosive growth trajectory of the sector over the past three years.

Several factors are driving investor interest:

- Revenue Growth: OpenAI has demonstrated strong revenue expansion through ChatGPT Plus subscriptions, API access, and enterprise solutions

- Market Leadership: The company maintains a commanding position in consumer-facing generative AI applications

- Technology Advancement: Continuous improvements to model capabilities and reasoning abilities

- Enterprise Adoption: Increasing deployment across Fortune 500 companies and institutional clients

Strategic Implications

A successful fundraising round at this valuation would provide OpenAI with substantial capital for:

- Research and development of advanced AI models

- Infrastructure expansion and computational resources

- International market expansion

- Talent acquisition and retention

- Potential strategic acquisitions

The timing of these discussions also reflects the competitive dynamics within the AI landscape, where companies like Google, Meta, and others are making significant investments in large language models and AI infrastructure.

Valuation Trajectory

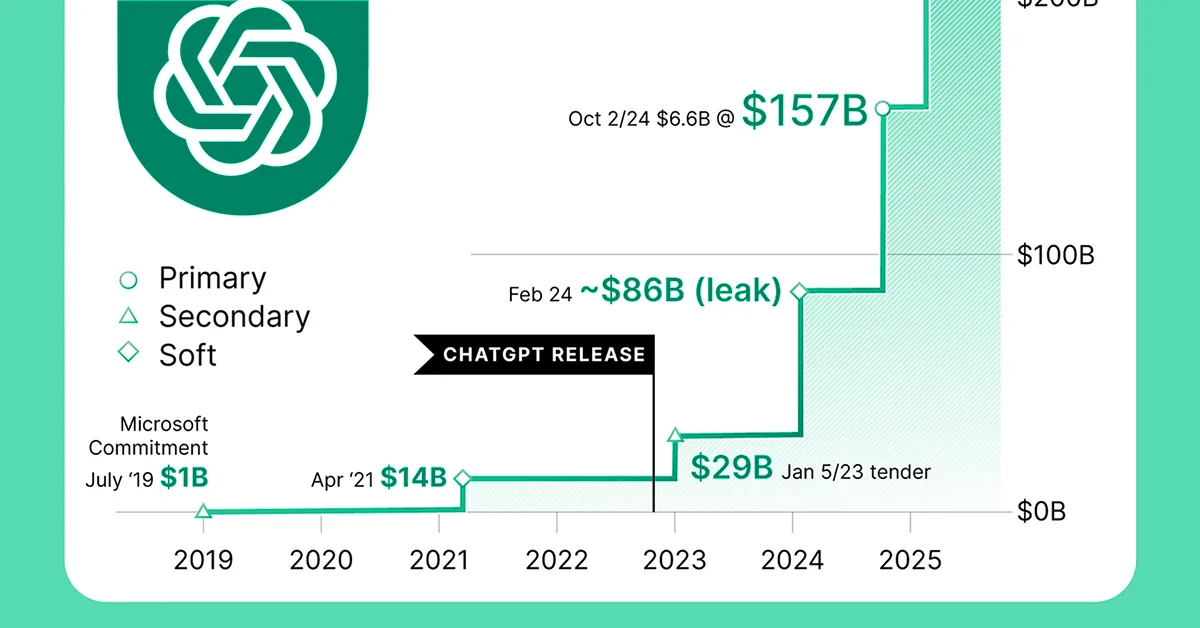

OpenAI's valuation progression illustrates the rapid capital deployment in the AI sector:

- 2021: $1 billion (Series B)

- 2023: $80 billion (Series C)

- 2024: $500 billion (Series D)

- 2025: $750 billion (reported discussions)

This exponential growth trajectory, while remarkable, also reflects the speculative nature of private market valuations and the premium investors are placing on AI leadership positions.

Key Considerations

Investors and analysts should consider several factors regarding this valuation:

Profitability Questions: While OpenAI has achieved significant revenue, questions remain about achieving sustainable profitability given the substantial computational costs of training and running large language models.

Competitive Pressure: The AI market is becoming increasingly competitive, with well-capitalized competitors from both established tech companies and well-funded startups.

Regulatory Environment: Evolving AI regulation could impact business models and operational costs.

Capital Requirements: The infrastructure demands for maintaining AI leadership require continuous substantial investment.

Looking Forward

The fundraising discussions signal OpenAI's confidence in its market position and growth prospects. However, the path from a $750 billion valuation to sustainable value creation will depend on the company's ability to monetize its technology effectively and maintain its competitive advantages.

Successful completion of this funding round would likely trigger additional capital deployment across the AI sector, further accelerating the industry's development and consolidation.

Key Sources

- Market reports on OpenAI's fundraising discussions and valuation metrics

- Visual Capitalist analysis of OpenAI's valuation trajectory and market positioning

- Industry analysis of AI investment trends and competitive dynamics